How To Trade The BoE Meeting?

Fact Checked

While the Bank Of England (BoE) is one of the most influential banks in the world, its monetary policy decisions and updates amid the national economy significantly influence the currency market. Therefore, you must understand how the BoE release may affect your trading strategy and how to trade it successfully. This article will help you know how to interpret the BOE economic release and analyze economic factors to make informed trading decisions. We'll also discuss what markets you should look to trade at the time of BOE interest rate decision news.

BOE's Impact on The Forex Market

The most important tool the BOE uses to create volatility in the market is the interest rate decision. When the BOE raises interest rates, this move attracts foreign investment and increases the British Pound (GBP) demand. Consequently, the value of GBP appreciates against other currencies. On the other hand, a low reading amid the interest rate decisions makes the pound less attractive for investors and leads to a diminishing GBP.

The bank's monetary policy also affects the forex market. For instance, an increase in the quantitative easing program reduces bond yields, affecting fixed-income securities performance and investors' sentiment, leading to a weakened British pound (GBP).

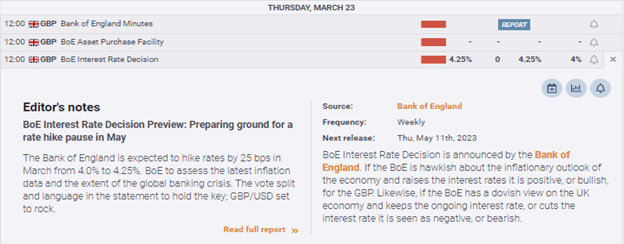

For instance, the BoE announced interest rates on Thursday (March 23, 2023), increasing them by 25 bps from 4% to 4.25%.

The interest rate hike immediately strengthened the price of GBP, as shown in the chart below.

Source: TradingView

Steps To Consider When Trading BoE?

Here we list the necessary steps to consider while trading the BoE.

1) Research and prepare: Before trading the BoE meeting, studying and understanding the factors that can impact the currency markets is essential. Keep updated with economic data releases and news events that could affect the market sentiment leading up to the meeting.

2) Analyze the market: Analyze the market using technical and fundamental analysis. Look for key support and resistance levels, trend lines, and other indicators to identify potential trading opportunities.

3) Monitor news and events: Keep an eye on any information leading up to the BoE meeting that could affect the market sentiment, such as political developments and other key economic releases.

4) Manage risk: Managing your risk is essential, so you must use stop-loss orders in addition to limiting your exposure to a single trade. Always consider the potential impact of the BoE meeting on your open positions and adjust them accordingly.

5) Monitor the meeting: Watch out for announcements and comments from the central bank officials. Pay attention to any changes in interest rates or policy guidance that could impact the currency markets.

6) Be patient: It's essential to be patient when trading the BoE meeting. The market can be volatile, and it may take time for a clear trading opportunity to emerge. Avoid making impulsive trades based on emotions or short-term market movements.

7) Review your trades: After the BoE meeting, review your positions and assess your performance. It will help you identify any areas for improvement and refine your trading strategy for future events.

How To Interpret The BoE Meeting?

Although you might find interpreting the BoE meeting a bit complicated, here are some points that may help you understand its impact on the currency market.

- Interest rates: The BoE's interest rates decision is the most crucial factor you must watch. If the bank decides to raise interest rates, the currency will likely appreciate because foreign investors start anticipating higher yields. Conversely, a cut in the interest rates weakens the GBP as investors seek higher returns elsewhere.

- Monetary policy: The BoE also provides insight into interest rates' future direction. Look for changes to the bank's economic projections and any indications of future policies.

- Economic outlook: The BoE's assessment of the economic outlook can also impact the markets. Look for any changes to the bank's growth or inflation projections, as well as any comments on the state of the economy.

- Market sentiment: The market's mood can also suggest how the BoE meeting will be interpreted. Always look for news and commentary that may surprise the market and cause it to react unpredictably.

- Forward guidance: Lastly, watch for any BoE future direction. Any predictions about interest rate changes or the bank's likely policy stances may instigate you to alter your positions.

What To Trade During BoE Release?

When the Bank of England (BoE) releases its monetary policy decisions, there are several instruments that you may consider trading. Here are some examples:

1. The Cable

The GBP/USD, also known as the cable, is one of the most popular currency pairs to trade during the BoE release. The release can cause significant volatility in the currency pair, so traders often look to capitalize on any price movements that occur.

2. UK Equity Indices

The release of the BoE's decision can also impact UK equity indices such as the FTSE 100. For example, if the BoE raises interest rates, this could positively impact bank stocks, driving up the FTSE 100 index.

3. UK Government Bonds

The BoE's monetary policy decisions can also impact UK government bonds, known as gilts. If the BoE raises interest rates, this could lead to a drop in gilt prices as yields rise. Traders may look to short gilts if this occurs. Apart from this, we also have another guide where you can learn how to trade nonfarm payrolls.

When To Trade The BoE?

The timing of events and releases is crucial when considering when to trade the BoE. Here are some key timings to keep in mind:

1) The BoE announces its interest rate decision eight times a year, usually on a Thursday at 12:00 pm GMT. Traders often pay close attention to the accompanying Monetary Policy Summary and any press conferences or speeches by BoE officials that follow the announcement.

2) Economic data releases that can impact the value of the GBP are usually scheduled for release at 9:30 am GMT. Examples of critical economic indicators include Gross Domestic Product (GDP), inflation figures (Consumer Price Index), and employment data (Average Earnings Index).

3) BoE officials often give speeches and interviews throughout the year. The timings of these speeches can vary, but traders should frequently monitor the BoE's website or news outlets for announcements.

Bottom Line

Trading the Bank of England (BoE) meeting can be a profitable opportunity for traders who have a solid understanding of the major events and releases that can impact the value of the GBP in the forex market. To successfully trade the BoE release, traders should pay close attention to interest rate decisions, economic data releases, and BoE speeches. Traders must also prepare for significant volatility and price movements using appropriate risk management strategies to mitigate their trading risks. Lastly, keeping yourself abreast of the market can help you capitalize on the BoE economic releases.

More Trading Guides: